🎥 Video: How Retailers Use Gamified Loyalty to Outperform Competitors.

Save your seat.

Loyalty fraud is one of the fastest-growing threats to loyalty programs. Cybercriminals and fraudsters have discovered that rewards points and miles serve as a form of currency. That makes loyalty accounts a tempting target, and we're now seeing fraudsters go after them with the same determination they once reserved for credit cards.

The scale is sobering: research shows that loyalty fraud has made up more than one in four online fraud attempts in recent years…

And while the financial losses are painful enough, the bigger damage often comes from a loss of customer trust. When members discover their points have been stolen, the brand takes the hit.

In this article, we'll break down what loyalty fraud actually is, the financial and reputational risks it creates for businesses, and, most importantly, how to prevent it. Learn practical strategies and discover how modern loyalty software features, from digital wallets to leaderboards and gamification, can help loyalty program owners stay ahead of the competition.

Loyalty fraud (also known as loyalty points fraud or rewards fraud) is the crime of stealing or misusing loyalty program rewards, points, or miles for financial gain.

In a typical loyalty fraud scheme, bad actors exploit vulnerabilities in a company's loyalty program, for example, by taking over customer accounts, creating fake accounts to game the system, or illicitly redeeming points.

Essentially, loyalty fraudsters are stealing a form of "soft currency" that businesses issue as rewards. These points and perks can often be converted into cash, goods, or services, making them an attractive target for criminals. And because loyalty accounts aren't monitored as closely as bank accounts, fraudsters see them as a low-risk way to profit.

Loyalty fraud is not a victimless act but a serious cybercrime. Companies hit by loyalty fraud may have to reimburse stolen points, give free rewards to appease customers, or even face legal issues (for example, when loyalty points are used for money laundering). For the victims (loyal customers), it feels like a personal theft, finding their hard-earned points drained and used by someone else.

And that's why loyalty fraud should be a top concern for any organization running a rewards program.

"As a rule, the more profitable a loyalty program is, the more interesting it is to cybercriminals. This is because illegal activity involving these programs requires less investment than fraud in the banking sector and doesn't pose any particular risks for those committing it," says Evgenia Naumova, Head of corporate sales, Kaspersky, source.

1. Loyalty program fraud has become a major global problem, now accounting for roughly one-quarter to one-third of all digital fraud attacks. Recent data show that loyalty fraud has made up more than one in four online fraud attempts, and the foremost experts in fintech and payment markets have revealed that the value of e-commerce fraud will rise from $44.3 billion in 2024 to $107 billion in 2029. It's a growth of 141%!

2. Experts warn this trend is accelerating: loyalty fraud was the 4th fastest-growing fraud type by 2024, with some studies finding it spiked about 89% year-over-year in recent years. In short, criminals are shifting from traditional card fraud into loyalty programs, treating points and miles as "digital currency" to steal.

3. Analysts estimate multi-billion-dollar annual losses from loyalty fraud. Thomson Reuters notes published estimates of roughly $1–$3 billion lost worldwide each year.

4. The Loyalty Security Association (LSA) pegs U.S. losses at about $3.1 billion in stolen reward-value per year. Companies then often re-issue stolen points out of pocket, effectively doubling the cost.

5. There is a vast stockpile of unused reward points worldwide – prime fuel for fraud. Bond Brand Loyalty and Gartner data estimate that about $48 trillion of unused points exist globally, including $140 billion in the U.S. alone.

6. Nearly half of loyalty members are inactive, leaving billions of dollars of points unmonitored and vulnerable to theft or abuse. For context, major programs hold enormous liabilities, e.g., AmEx Membership Rewards was ~$13.7B at the end of December 2023, and Delta SkyMiles was ~$7.6B at the end of February 2022 on their books.

7. Multiple sources report dramatic recent growth. One industry study (Forter) found loyalty fraud cases up +89% in just a few years. Another source says that there are 30–40% spikes in airline account-takeover fraud and a 166% surge in bot attacks on airline sites in 2022–2023.

8. Global fraud surveys note loyalty attacks are rising, e.g., 75.7% of travel/airline merchants saw loyalty fraud increase in the past year. In short, loyalty fraud is growing far faster than overall fraud, projected to "quadruple" over the next decade by some counts as fraudsters target less-protected rewards programs.

9. Organized fraud rings routinely cash out stolen points. For example, research in Australia found about 3% of frequent-flyer members were hit by account-takeover fraud in one year (with programs like Qantas holding ~$2B in liabilities). Group-IB reported dozens of organized networks targeting 75+ airlines, showing the scale of point-theft schemes.

10. Even outside travel, everyday programs see losses: one loyalty security survey estimates that $3.1 billion in rewards value is fraudulently redeemed each year (U.S.).

Loyalty programs were once seen as low-risk, but that perception has changed dramatically. As reward points have grown into a multi-billion-dollar currency, fraudsters have followed the money. Advances in cybercrime tactics, a surge in digital loyalty platforms, and massive amounts of unredeemed points sitting idle in customer accounts have made these programs irresistible targets.

At the same time, many businesses have historically invested more in protecting payment systems than in safeguarding loyalty data, creating gaps that attackers are quick to exploit. The result is a steady increase in both the volume and sophistication of loyalty fraud attempts.

Find out several factors that contributed to a sharp rise in loyalty program fraud in recent years.

More companies than ever offer loyalty points and rewards, creating a bigger "prize pool" for criminals. Inactive or unspent loyalty points worldwide are worth astonishing sums (one analysis estimated $48 trillion in unredeemed points globally), effectively a massive pot of currency waiting to be stolen.

As loyalty programs proliferate, so do opportunities for fraud.

Loyalty points have become a sort of shadow currency that fraudsters can trade or sell online with less scrutiny than cash. There are thriving black markets on the dark web for stolen reward points and miles. Criminals know they can convert stolen points into gift cards, flights, electronics, or even cash with relative ease, so the incentive is high.

Loyalty programs have embraced digital access (mobile apps, websites), but security hasn't always kept up. Users often reuse weak passwords, and companies historically imposed fewer security measures (like multi-factor authentication) on loyalty accounts than on financial accounts.

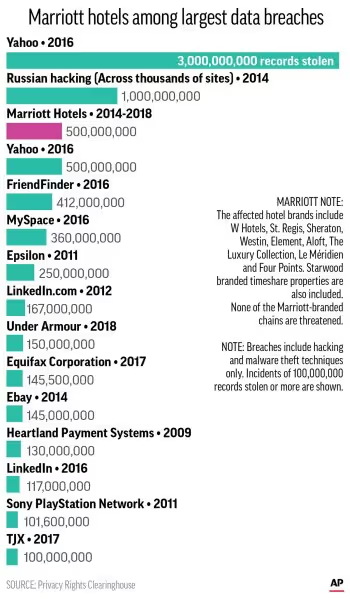

Massive data breaches have also exposed millions of login credentials, which fraudsters then use in credential stuffing attacks to hijack loyalty accounts. In short, the move online has opened new doors for hackers.

Remember that the mentioned mobile apps are increasingly the frontline for fraudsters, but they can also be designed to be more secure. Explore proven mobile loyalty app features that support both usability and fraud protection.

Many organizations focus their anti-fraud efforts on credit card or bank fraud, while loyalty fraud flies under the radar. Loyalty teams may lack the same tools and regulations that protect financial accounts. Fraudsters are well aware that loyalty programs often have weaker security and oversight, making them soft targets compared to heavily regulated banking systems.

Loyalty program customers themselves tend to be less vigilant with loyalty accounts. They might not check point balances frequently or set strong passwords. Such a "security fatigue" among users leads businesses to be cautious about adding friction (like extra login steps), sometimes at the cost of security. Fraudsters exploit this by sneaking in under the radar of both companies and customers.

Fraud in loyalty programs shows up in different ways, and no two cases look exactly alike.

Some attacks come from hackers who break into accounts from the outside, insiders with system access cause others, and some are simply members who push the rules too far. Looking at these categories separately helps loyalty owners understand where the weak spots are and how to address them before they grow into bigger problems.

Loyalty fraud can take many forms. Generally, these incidents fall into three main categories: external fraud, internal fraud, and friendly fraud.

It's the classic scenario of outsiders hacking loyalty accounts. Fraudsters use techniques like phishing, malware, or stolen passwords to perform account takeover (ATO) attacks, breaking into real customers' accounts and draining their points.

"ATO remains one of the financial services industry's greatest fraud concerns. Not surprisingly, consumers rarely consider accounts linked to rewards, such as retail and travel, at risk of attack. Because of that, consumers take few measures to ensure they use strong passwords that contain multiple and mixed characters across retail and travel accounts. That makes those types of accounts easy targets for cybercriminals to take over and cash out on," says Tracy Goldberg, Director of Cybersecurity at Javelin Strategy & Research, source.

They may also set up fake websites or fake mobile apps to trick users into giving up login credentials. Once in control, the hackers redeem points for rewards (flights, gift cards, and so on), transfer points to mule accounts, or sell the points on illicit marketplaces.

External fraud also includes organized rings that exploit software vulnerabilities, for example, a hacker finding a flaw in a points platform's API to generate or steal millions of miles illicitly. The cybercriminal category is currently the largest source of loyalty fraud by volume.

Many breaches happen through weak integrations or outdated systems. Understanding how to connect tools securely is covered in our API-first loyalty engine guide.

Not all threats come from outside. Employees or partners with access to the loyalty system can commit insider fraud. It could be a customer service rep quietly applying unused rewards to their own account, or an employee creating fake loyalty accounts to siphon points.

Insiders might also manipulate redemptions or issue themselves gift cards. Because they have legitimate access, insider fraud can be hard to detect without proper controls. Open Loyalty experts spotted that a significant portion of loyalty fraud originates from within the organization, such as staff or third-party vendors misusing their privileges. Robust internal audits and checks are needed to catch these cases (more on prevention later).

Read more on how to address common challenges when implementing a loyalty program.

So-called "friendly" fraud occurs when actual loyalty program members game the system. These are often your own customers finding loopholes or bending rules to get more rewards than they should. Examples include "double dipping," where a member redeems the same points twice via different channels, or a member using multiple accounts to snag signup bonuses repeatedly.

Other cases are abusing promotional codes, making fake complaints to score compensation points, or buying and returning products to earn points, then getting a refund. While these individuals aren't hackers, their behavior is fraudulent from the business's perspective. Friendly fraud can be challenging because it involves real customers exploiting trust. You need to enforce fair-use policies without alienating loyal users.

Not every scheme fits neatly into a single category.

Fraudsters often use a mix of tricks to slip past program defenses, from phishing emails to bots running stolen credentials. Some take advantage of loopholes in program rules, while others create fake accounts to farm sign-up bonuses. These tactics constantly evolve, making it even more critical for loyalty owners to know what's out there and keep an eye on unusual patterns.

In addition to the broad categories mentioned in the section above, fraudsters use specific tactics to steal loyalty rewards. Read further about some notable methods.

Using large sets of stolen username/password combos to break into accounts (hoping customers reused passwords). The automated attack can take over multiple accounts simultaneously if successful.

Sending fake emails or texts that impersonate the loyalty program, tricking members into entering login details on a fake site. The fraudster then uses those credentials to access real accounts.

Signing up for new accounts with fake identities or multiple emails. Scammers do this to abuse signup promotions or referral bonuses, or to later merge and cash out points.

Some insiders create "ghost accounts" to dump points into them unnoticed.

Exploiting flaws in the program rules, for example, repeatedly canceling and rebooking travel to earn points multiple times, or using family pooling features in unintended ways.

Any poorly designed rule can be abused for extra rewards.

Hacking the loyalty database itself or a connected system to steal customer data and points. For instance, a 2023 breach exposed millions of airline loyalty records and even allowed hackers to add or remove points at will. Such breaches not only lead to immediate fraud but also compromise personal data (a double hit for businesses).

Overall, each of these three categories requires different countermeasures. External attacks call for strong cybersecurity, internal fraud demands oversight and permissions control, and friendly fraud requires clear rules and user behavior monitoring. Importantly, all three types of loyalty fraud can co-occur in an extensive program: a comprehensive fraud prevention plan must address outsider threats, insider abuse, and user misconduct alike.

Some of the most damaging fraud doesn't come from hackers, but from repeat users creating fake accounts to exploit marketing campaigns. A common method involves registering multiple accounts to redeem welcome bonuses, referral rewards, or birthday gifts multiple times. For instance, a user might sign up with 10 email addresses to claim 10 new-user coupons and use them before detection. This form of loyalty points fraud is difficult to stop without backend protections like device fingerprinting, velocity checks (e.g., too many accounts from the same IP), and identity validation.

Airline and hotel loyalty programs often allow mileage pooling, family sharing, or third-party booking access, which opens the door to organized exploitation. Fraudsters aggregate points from multiple loyalty accounts, sometimes stolen, sometimes fake, into a central pool. These schemes are difficult to track when done at scale if reward transfers or pooling rules aren't audited. Because of the liquidity of airline miles, these cases often involve six-figure losses and long investigations.

Returns abuse blends friendly fraud and system manipulation. The tactic works like this: a customer purchases an item, redeems loyalty rewards for an instant perk (e.g., cashback, points, or vouchers), then returns the product shortly after. If the system doesn't reverse the reward transaction, or if the fraudster uses a different return method, the customer keeps both the refund and the bonus. Some go further by coordinating multiple purchases to trigger reward thresholds (e.g., spend $500, get 5,000 points), then immediately cancel the order or initiate staggered returns. Without strict fraud logic, these cases can be hard to flag in real time.

Once attackers gain access to loyalty accounts, through account takeover or phishing, they extract the stored rewards and sell them in bulk. Airline miles, hotel nights, digital gift cards, and even event tickets are frequently traded on dark web marketplaces. The resale process often involves intermediaries posing as travel agents, ticket sellers, or coupon "exchanges." For example, a batch of 100,000 stolen hotel points might be sold at 20% of its redemption value to a reseller, who then books rooms for customers at a markup. Because these redemptions appear legitimate, they often bypass initial review unless anomaly detection is in place.

Every business with a loyalty program faces some level of risk, but not all programs are hit equally.

Fraudsters tend to focus on industries where points and rewards carry high resale value or can be turned into cash, travel, or merchandise with little effort. Airlines, hotels, retailers, and banks sit at the top of that list, while smaller programs can also become soft targets if their defenses are lighter.

Looking at where fraud happens most often helps loyalty owners understand why certain industries attract more attention and what lessons can be borrowed across sectors.

Loyalty programs in the travel industry, especially airlines and hotel chains, are among the most heavily targeted by fraudsters. These programs often carry high-value point balances, offer transferable rewards, and allow redemptions across partners, making them a perfect target when security is lacking.

According to Transmit Security, major travel and hospitality companies lose over $1 billion per year to loyalty fraud. The same report notes that roughly 46% of airline bookings are tied to fraud-related schemes. A Ravelin study cited by Mastercard found that 75.7% of travel-sector merchants reported a year-over-year increase in loyalty fraud attempts.

This trend isn't new. Even back in 2017, over 60% of airlines had experienced loyalty fraud incidents, and the problem has only intensified with the rise of digital booking and mobile check-ins. Mastercard also reports multi-million-dollar loyalty fraud losses across the airline sector, often stemming from account takeovers, partner abuse, or identity manipulation.

High-profile breaches illustrate the risks. In 2023, Caesars Entertainment paid a $15 million ransom after attackers stole the company's entire loyalty database, including sensitive personal data.

That same year, MGM Resorts suffered a cyberattack with over $100 million in damages, exposing loyalty member accounts and disrupting operations.

Earlier, in 2018, the Marriott breach compromised the data of millions of loyalty members, including stored point balances and account credentials.

Airline miles in particular have become a kind of underground currency. They're actively sold on the dark web and are considered a high-value asset by fraudsters when paired with weak password protection or poor account monitoring.

Travel and hospitality brands now face a continuous onslaught of loyalty-related fraud attempts. If loyalty currency remains poorly secured, the sector will continue to absorb steep financial and reputational losses.

"Thinking that we are getting something for free weakens our efforts to protect accounts of loyalty programs we participate in. Some loyalty programs provide tangible benefits, like gift cards, products, cheaper flight tickets, or tickets to theme parks or concerts. These are assets that have concrete financial value, and they are targeted by cybercriminals," says Adrianus Warmenhoven, a cybersecurity advisor at NordVPN, source.

Retail and e-commerce loyalty programs have become a growing target for fraud, with attackers exploiting account takeovers, promo abuse, and fake account schemes to drain rewards and game the system.

According to Forter, loyalty-linked accounts are attacked 4 to 5 times more often than non-loyalty customer accounts. A separate study cited by Opia found that loyalty fraud now accounts for about 27% of online fraud attempts, often tied to redemptions, gift card conversions, or discount-code manipulation.

Despite these risks, many retailers remain underprepared. Research shows that 42% of merchants report inadequate fraud protection, and over half admit loyalty fraud is still a low internal priority. This opens the door to abuse of digital coupons, promo codes, and referral programs.

Even small businesses aren't immune. In one notable 2024 case, a UK café owner was sentenced to jail for £21,000 in loyalty fraud, after abusing his shop's welcome-offer scheme using fake referrals and multiple accounts (DataDome).

From independent merchants to major e-commerce brands, fraudsters are exploiting every angle, from leaked coupons to automated bot attacks, to turn loyalty perks into profit. As reward points and promotional offers increasingly resemble digital currency, retailers must take loyalty fraud as seriously as payment fraud.

Restaurant loyalty programs are frequent targets of fraud and abuse due to their simplicity, speed of use, and generous promotional mechanics. These programs often focus on customer retention through perks like free drinks, loyalty stars, birthday offers, or order-based rewards. But when verification is weak or redemptions are easy to manipulate, they become vulnerable.

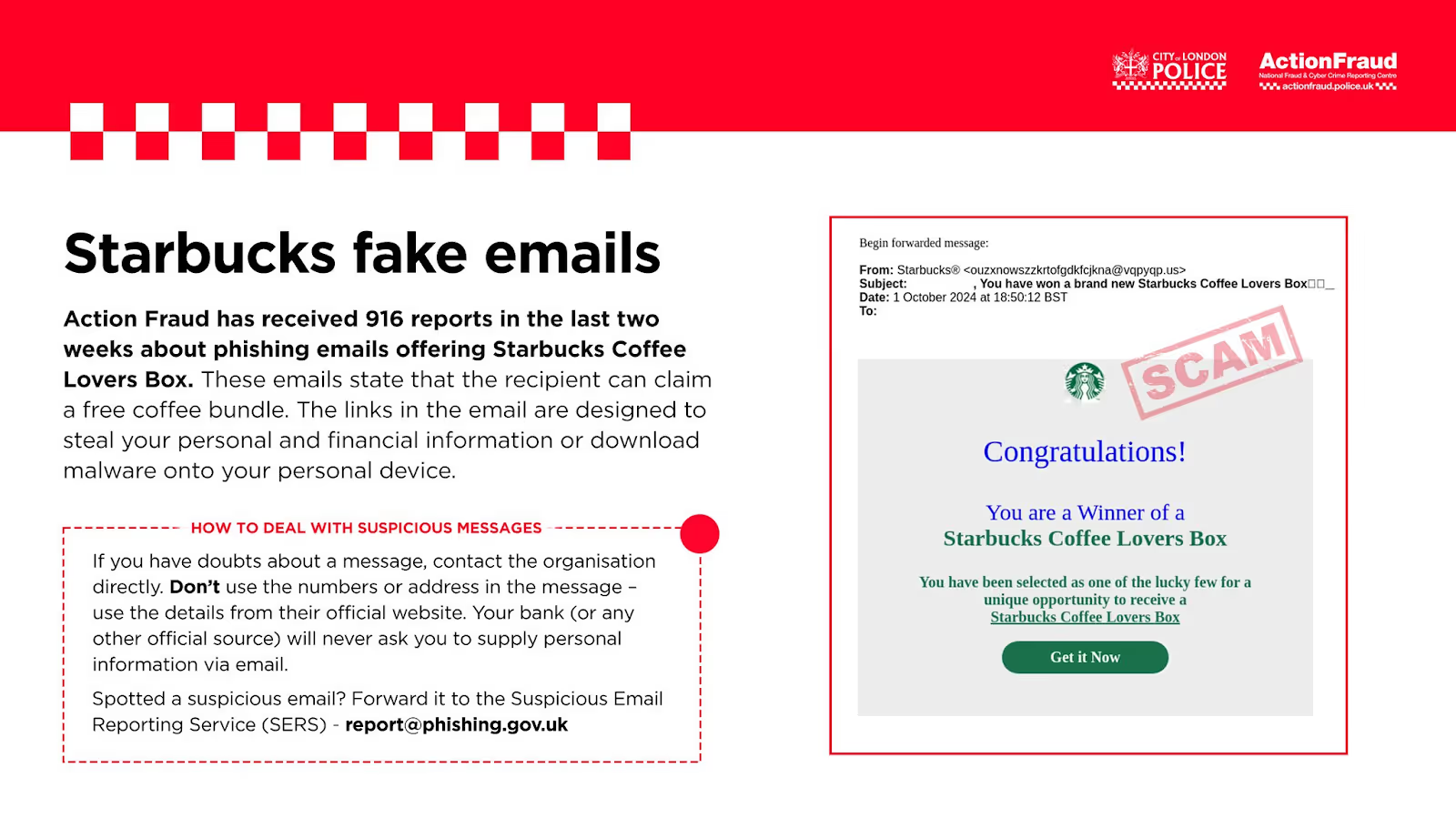

In October 2024, the UK's City of London Police and Action Fraud issued a warning after receiving over 900 reports in two weeks about fake Starbucks emails offering a "Coffee Lovers Box" reward. The phishing messages claimed recipients had won a free coffee bundle, prompting them to click malicious links disguised as Starbucks promotions.

These emails were designed to steal personal and financial information or install malware, targeting not only consumers' devices but also their Starbucks Rewards accounts. Victims who clicked the fraudulent link risked handing over sensitive login credentials or downloading malicious code. The scam mimicked official Starbucks branding and messaging, making it hard to detect for casual users.

Banks and fintech companies operate some of the most valuable and complex loyalty ecosystems, including credit card reward programs, transferable points, and cashback offers. These loyalty currencies often mirror cash in utility and value, making them a top target for fraudsters.

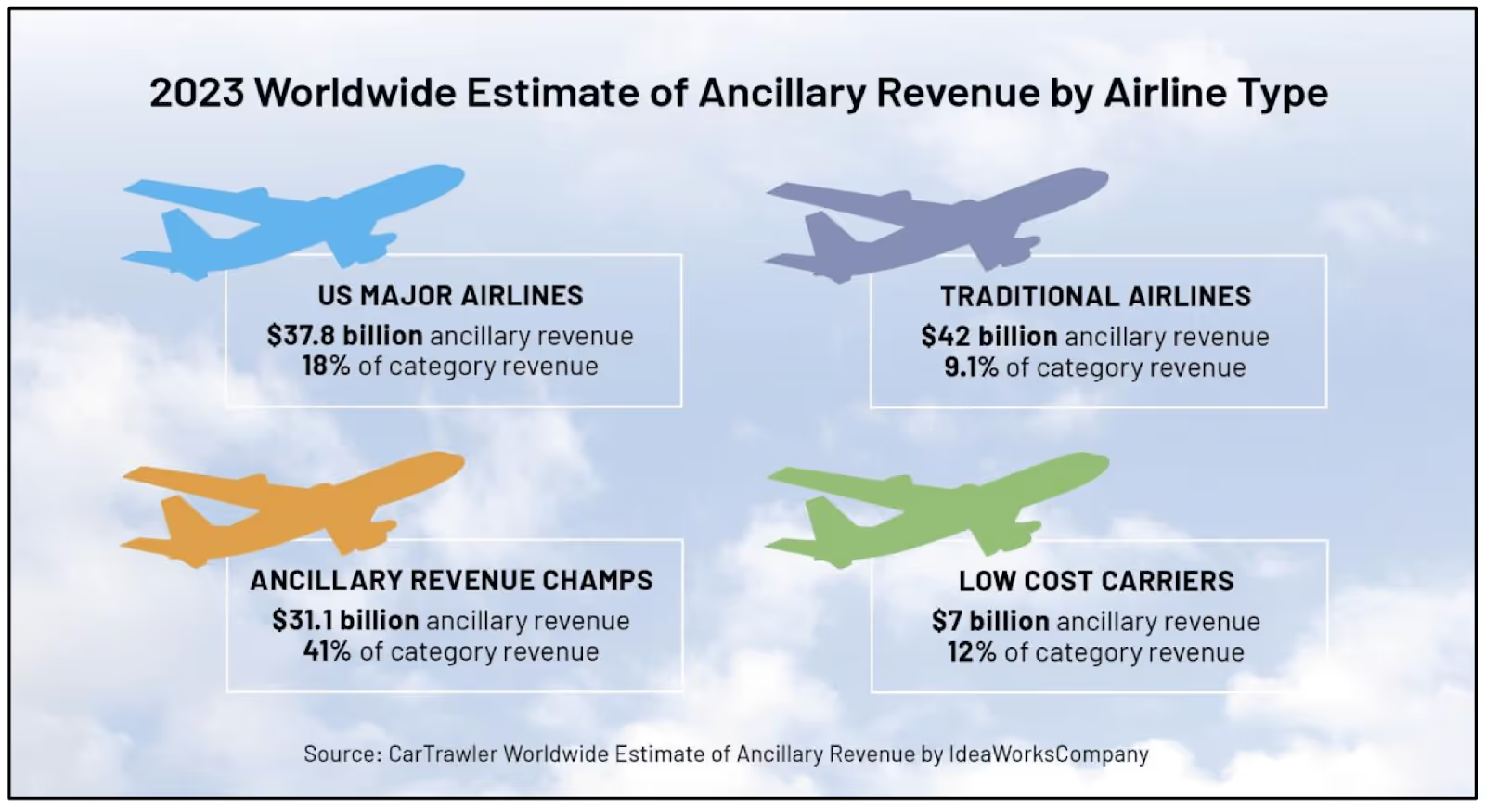

According to Arkose Labs, co-branded credit cards generate over $25 billion in ancillary revenue and store hundreds of billions of dollars' worth of points. These rewards can often be converted into statement credits, gift cards, or travel, turning them into digital currency substitutes.

This flexibility makes financial services especially vulnerable to exploitation. As reported by The Paypers, loyalty fraud in banking is increasingly tied to broader financial crime, including points laundering, where illicit funds are converted to points and then cashed out through redemptions or transfers.

Forter also highlights the risk of cross-channel reward systems, where points can be moved between programs or brands. These systems are 2.5× more likely to be attacked than single-channel programs due to their complexity and broader attack surface.

Major issuers like AmEx, Delta, and Chase operate loyalty programs holding billions in liabilities, making them attractive to criminals aiming to convert stolen credit card access into redeemable rewards. In some schemes, attackers use compromised accounts to drain reward balances, redeem perks, or convert points into digital gift cards, which are then sold or laundered.

As loyalty points increasingly function as shadow currency, financial services firms are starting to treat loyalty fraud with the same level of scrutiny as traditional cybercrime, but there's still a long way to go.

Air Miles coalitions, gaming and streaming services, coalition loyalty programs, and any business with a high-value points system can be at risk. Even small businesses with punch-card style rewards could face fraud if, for example, employees issue themselves fake "punches" or savvy customers digitally manipulate app data.

⚠️ Any industry that runs a loyalty or rewards system needs to be aware of fraud risks, but travel, retail, and financial services see the highest volumes due to the high value and liquidity of their rewards.

When loyalty fraud hits, the damage isn't limited to stolen points. Companies often find themselves covering the financial loss, handling angry customers, and cleaning up reputational fallout that lingers long after the incident.

Fraud can also disrupt customer engagement, inflate operational costs, and even create legal headaches if regulators get involved. Breaking down these risks makes it clear why loyalty fraud can quickly shift from a minor incident to a major business problem.

Loyalty fraud can have serious financial and reputational consequences for businesses. Below you'll find the key risks to understand.

When fraudsters steal points or rewards, the company often bears the cost. For example, if hackers redeem $100,000 worth of free flights or merchandise, that's a direct loss of inventory or revenue for the business.

A study by the Loyalty Security Association estimated $3.1 billion in loyalty rewards value is stolen annually in the U.S. alone. Additionally, companies frequently choose to compensate affected customers with replacement points or other goodwill credits, essentially paying for the fraud twice.

Over time, these losses add up and can run into the millions per incident for large programs!

Perhaps even more damaging, loyalty fraud erodes customer trust in the program and the brand. Loyal customers expect their hard-earned points to be safe. If accounts are compromised or points vanish, members naturally feel betrayed and unsafe. Publicized incidents of loyalty program breaches or fraud can lead to bad press and social media backlash, tarnishing the brand's image.

Customers might hesitate to join or engage in the program if they don't feel their rewards are secure. In extreme cases, a major fraud incident can devalue the entire loyalty currency if people lose confidence (much like a bank run in miniature). Protecting the integrity of the loyalty program is therefore fundamental to maintaining strong customer relationships.

Loyalty programs thrive on member engagement, so frequent earning and redeeming of rewards. Fraud undermines this in multiple ways. Victims of fraud may stop using the program (fearing it's not safe) or disengage out of frustration. Even those not directly hit might reduce their activity if they perceive the program isn't secure.

Additionally, if a business has to implement emergency measures (like freezing point redemptions during an investigation), that pause in normal operations can annoy and alienate members. In short, fraud can lead to loyal customers becoming former customers, directly impacting retention and lifetime value.

Fraud often reveals itself in redemption data. Sudden spikes or odd timing can be red flags. Learn how to interpret these patterns in our redemption rate article.

Dealing with loyalty fraud drives up costs beyond the lost rewards themselves. Companies have to investigate incidents (hiring fraud analysts or external experts), invest in fraud detection tools, handle customer support calls and complaints, possibly engage legal counsel or regulators (if personal data was compromised), and improve security infrastructure.

There may also be costs for system fixes or audit processes to prevent future incidents. All these expenses eat into the ROI of the loyalty program.

In one survey, nearly half of merchants admitted they lacked sufficient resources and skills internally to manage loyalty fraud, meaning they face steep learning curves and potentially expensive fixes when fraud strikes.

While loyalty programs aren't as regulated as bank accounts, that is changing. If a loyalty fraud incident involves a data breach (exposing personal info) or crosses into financial fraud (points laundering, etc.), regulators could step in, especially in more strict jurisdictions.

Companies might face penalties under data protection laws if they fail to safeguard user data in the loyalty platform. There's also the risk of lawsuits from consumers if widespread fraud occurs due to negligence. Ensuring adequate fraud prevention can mitigate these legal risks and demonstrate that the company takes due care of customer assets.

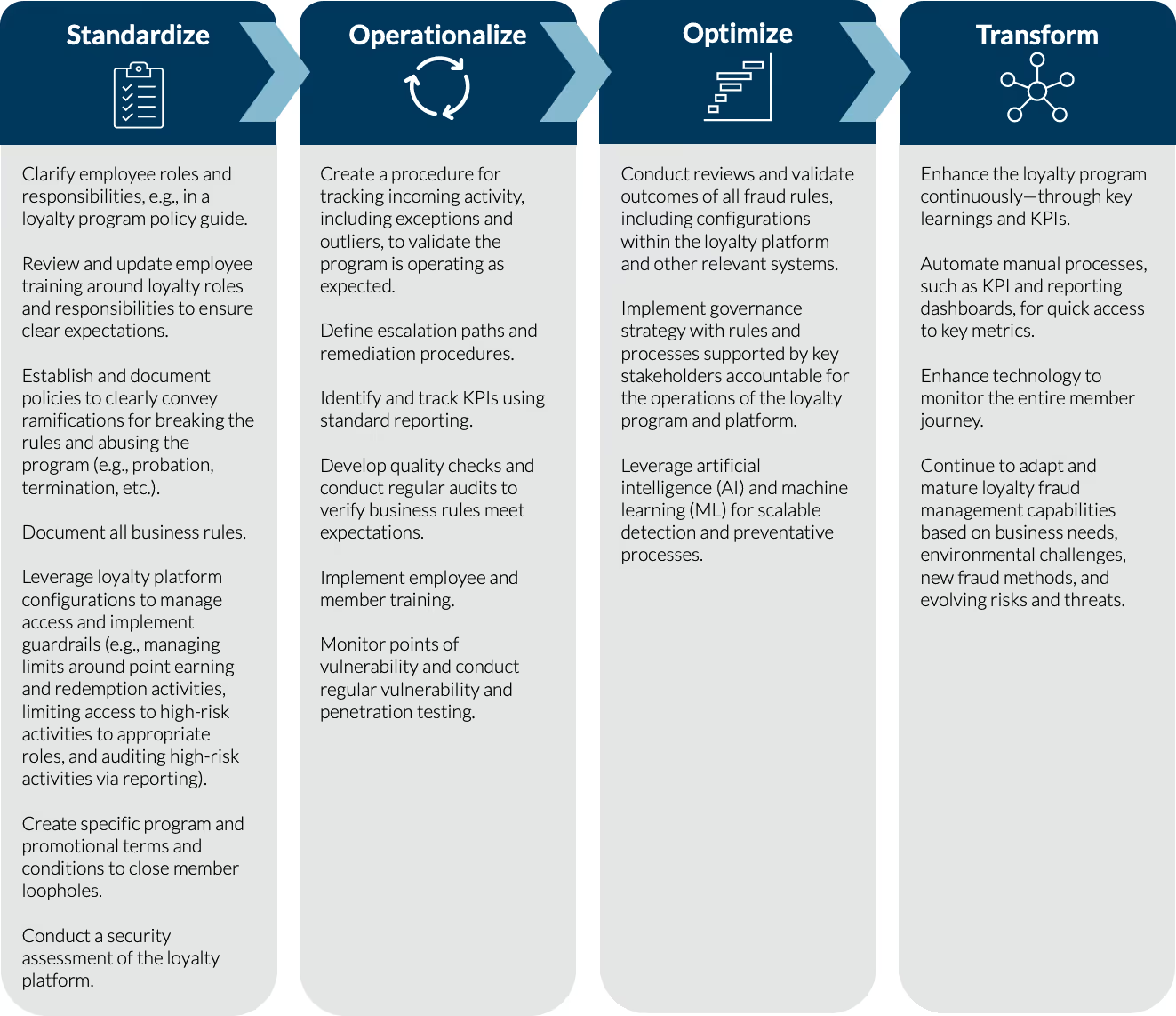

Preventing loyalty fraud requires a multi-faceted approach that combines technology, process, and education. Read about several strategies to mitigate loyalty program fraud, and how modern loyalty software features can help implement them.

The first line of defense is to secure customer accounts against takeovers. Require strong, unique passwords and encourage or mandate two-factor authentication (2FA) for logins. 2FA (such as a one-time code sent to the user's phone) can stop many account takeover attempts cold, even if passwords are compromised.

Additionally, implement device recognition and alert members about logins from new devices or locations (much like banks do). Many modern loyalty platforms integrate with authentication services or allow 2FA setup for users.

Make sure to also limit login attempts and use CAPTCHA or bot detection to prevent automated credential stuffing. While adding security steps can introduce a bit of friction, it dramatically reduces the risk of external hacks, and customers will appreciate the extra protection if communicated well.

Leverage data analytics and fraud detection tools to keep an eye on unusual patterns in your loyalty program. For example, set up alerts for when a single account redeems an abnormally large amount of loyalty points in a short time, or when there are rapid multiple logins/failures (suggesting bot attacks).

Machine learning can be truly useful: it can learn what "normal" behavior looks like for your members and flag anomalies in real time. Some loyalty software solutions have built-in fraud monitoring dashboards or APIs to integrate with fraud detection systems.

At minimum, loyalty program managers should review daily reports for anomalies – as one of our internal guides suggests, daily anti-fraud checks are necessary to catch issues early. If you spot a suspicious pattern (e.g., a spike in point redemptions at odd hours), investigate promptly before it escalates.

For more on spotting unusual redemption behavior, see our guide on how to protect against fraud in the pay-with-points mechanism.

The structure of your loyalty program can either help or hinder fraud prevention. Design your program rules with fraud in mind. For instance, set reasonable limits on points transfers, redemptions, or accruals in a given period to cap how much a fraudster could steal quickly.

Many loyalty platforms (including digital wallet features) let you configure such limits. With Open Loyalty's wallets module, for example, you can define anti-fraud rules like maximum points earned per day or expiration dates on unused points. These controls prevent fraudsters from exploiting unlimited earnings or stockpiling points indefinitely.

Similarly, require verification steps for high-value reward redemptions (like redeeming a $500 gift card might trigger an email confirmation or manual review).

Another design tip: avoid single-factor account recovery processes. If "forgot password" only asks for an email, attackers might abuse it. Incorporate secure verification for account changes.

By conducting a vulnerability assessment of your loyalty program's design upfront, you can patch weak points (e.g., overly lenient rules) before fraudsters find them.

Insider fraud prevention is critical. Limit how many employees can access loyalty account data or alter point balances, and use role-based permissions so staff only have the access needed for their job. All admin actions (like manual point adjustments) should be logged and audited regularly.

If possible, implement dual control for risky operations (for instance, two people must sign off to issue a large amount of points to a member). Conduct background checks on loyalty program administrators and train employees on ethics and fraud awareness. It's also wise to rotate duties or have mandatory vacations. Techniques known to help detect internal fraud by ensuring no single employee can cover their tracks continuously.

Our article on common loyalty program challenges notes that a significant portion of loyalty fraud comes from inside the organization, so preventive measures are a must. Consider having a separate fraud team or at least a point person responsible for monitoring for both external and internal fraud signals. In short, treat your loyalty system with similar care as you would financial systems when it comes to internal controls.

Your members can be allies in fraud prevention if you empower them. Educate loyalty program members about basic security hygiene: using unique passwords, enabling 2FA if available, and being vigilant about phishing attempts. Regularly remind users to check their point balances and account activity. Surprisingly, over half of loyalty members rarely monitor their accounts, which means fraud can go unchecked for longer.

Encourage them to report any suspicious transactions (like points they didn't redeem). You can even build security into your engagement strategy: send out a friendly quarterly email saying "Here's how to protect your rewards from fraud" with tips.

Some programs offer incentives for customers to proactively review and update their security settings (for example, earn 100 points for adding a backup email or phone number to aid account recovery). Customer education reduces the chances they'll fall for scams and can alert you early if something's amiss. It also signals that your brand values their security, which can deepen trust.

Modern loyalty program software can greatly assist in fraud prevention if you utilize its features. A few examples to leverage:

A digital loyalty wallet system lets you manage points like a currency. Take advantage of settings like balance thresholds, expiration policies, and transactional limits to prevent abuse. For instance, you might cap the number of points redeemable in a single day, or require manager approval for very large point redemptions.

Wallets also provide a clear ledger of all point movements per member, which aids in auditing and tracing suspicious activity.

Gamification features created with the help of the gamification software (achievements, leaderboards, challenges) may not seem directly related to fraud prevention, but they can help in two ways. The biggest benefit is boosting engagement and user awareness. Members who log in frequently to track progress or compete on leaderboards are more likely to notice if something looks off in their accounts, instead of leaving them dormant and vulnerable.

Leaderboards also add a layer of visibility. When unusual activity pushes an account to the top too quickly, it can serve as a natural signal for the loyalty team to investigate. In this way, gamification doesn't prevent fraud on its own, but it makes the community more active, and that activity makes suspicious behavior harder to hide.

(Just make sure the gamification mechanics themselves can't be exploited, for example, by validating actions so bots or scripts can't generate fake achievements.)

Choose a loyalty platform that supports real-time event triggers and integration with your wider security systems. For example, Open Loyalty's API and webhook capabilities allow you to send events (like a redemption or profile change) to an external fraud monitoring service or to your CRM for follow-up.

You could set an alert: "If more than 5,000 points are redeemed within 10 minutes, flag this in our system." Some platforms even have built-in fraud rules engines or allow plugin modules for fraud scoring.

Use these tools so that your loyalty system isn't siloed. It should communicate with your overall fraud prevention infrastructure (such as your e-commerce fraud detection or SIEM for security events).

A final but important point: in implementing all these measures, strive to maintain a positive customer experience. One reason loyalty fraud has flourished is that companies feared adding security friction that might deter customers (like extra logins or verification steps).

However, there are ways to secure your program without ruining UX. For instance, use risk-based authentication – only prompt 2FA or step-up verification for high-risk transactions, letting routine point checks remain simple. Employ invisible reCAPTCHA or bot detection in the background of your loyalty site to weed out attackers without making legitimate users fill out puzzles.

When you do implement security features for users, frame them as benefits ("Protect your rewards with an extra passcode") rather than burdens. Many customers will understand that a slightly longer login is worth it to keep their hard-earned rewards safe.

The best loyalty platforms today focus on security + convenience, using techniques like device fingerprinting, anomaly detection, and password-less logins to enhance security while even improving user experience. By finding the right balance, you ensure that fraud prevention measures don't themselves drive customers away or discourage engagement.

The "crime of loyalty fraud" refers to any fraudulent activity where someone steals or abuses a company's loyalty rewards for financial gain. It can involve hacking into loyalty accounts, creating fake accounts to rack up points, or misusing program rules to claim undue rewards.

In essence, it's theft of a business's reward value (points, miles, coupons), and it is illegal. Loyalty fraud can be prosecuted under cybercrime, fraud, or theft statutes, depending on the nature of the scheme and jurisdiction. Companies treat loyalty fraud very seriously because it is a form of property theft and can be linked to larger crimes like identity theft or even money laundering.

Reward fraud is essentially another term for loyalty fraud. It means any fraudulent scheme involving customer rewards or loyalty points. Think of someone hacking into a rewards account, generating fake reward vouchers, or otherwise cheating a loyalty/rewards program.

The term "reward fraud" might also be used in contexts like credit card rewards or promotional giveaways, but in all cases, it implies misuse or theft of the rewards intended for genuine customers.

If you hear about "rewards fraud" or "points fraud," it's referring to the same concept of loyalty program abuse and theft of reward value. Businesses combat reward fraud by implementing the preventive steps discussed above, ensuring the integrity of their loyalty and reward systems.

Cost is often overlooked in fraud planning, but budgeting correctly can reduce risk. Here's a guide on loyalty program costs to keep financial planning aligned with fraud mitigation.

Yes. Fraud isn't always carried out by hackers. Members sometimes commit fraud by creating multiple accounts, exploiting loopholes, or abusing promotional offers. While they may look like legitimate accounts on the surface, their activity often breaks program rules and ends up costing businesses both rewards and trust.

Fraud detection solutions monitor loyalty transactions in real time and flag suspicious behavior. For example, they can spot unusual transaction patterns, sudden spikes in redemptions, or repeated attempts to gain access from different devices. These tools give loyalty managers an early warning system so they can act before points are drained or accounts are taken over.

Regular audits are a proactive way to surface hidden risks before they turn into losses. Our step-by-step loyalty program health audit explains how to spot vulnerabilities.

Stronger security measures include multi-factor authentication, device recognition, and limits on high-value redemptions. These controls make it harder for criminals to gain access to accounts, even if they have stolen credit card information or login credentials from data breaches. A layered approach keeps both the program and its members safer.

Most attackers gain unauthorized access by using stolen credentials from data breaches, phishing emails, or fraudulent websites that mimic real login pages. Once they're inside, they redeem points, transfer balances, or sell the rewards on dark web marketplaces. That's why ongoing fraud mitigation is so important for any program with valuable rewards.

Loyalty points hold real monetary value. They can be converted into flights, hotel stays, gift cards, or even resold online. Many retailers also allow points to be used directly at checkout, making them an easy target.

Because programs often move large volumes of loyalty transactions daily, fraudsters see plenty of opportunities to slip in unnoticed.

Fraudsters exploit promotional offers by creating fake accounts to claim sign-up bonuses, running bots to farm referral credits, or repeatedly canceling and rebooking purchases to earn points multiple times. These tactics may not involve stolen credit card information, but they still drain program resources and reduce the impact of promotions intended for real customers.

Data breaches are one of the main drivers of loyalty fraud. When login details or personal data are exposed, criminals can use that information to gain access to accounts, impersonate members, or commit fraud at scale.

Multiple breaches feed dark web marketplaces with fresh credentials, making it easier than ever for attackers to launch loyalty fraud campaigns.

Protecting loyalty accounts requires a layered approach that addresses both technical vulnerabilities and policy loopholes. At the technical level, the first line of defense is strong customer authentication, using multi-factor authentication (MFA), device fingerprinting, and IP monitoring to reduce the risk of unauthorized redemption. Loyalty programs should also monitor for signs of reward point theft, like sudden balance transfers or redemptions outside a member's typical behavior.

On the policy side, rules should be in place to detect and block promo abuse, for example, capping redemptions per user or limiting referral bonuses to verified accounts. Without controls like these, bad actors can exploit loyalty currency by opening fake accounts, farming bonuses, or repeatedly abusing promotional offers.

It's also essential to track for points laundering, where fraudsters convert stolen payment credentials into loyalty rewards (or vice versa). If those points can be traded, transferred, or redeemed for high-value items, they become a prime target. Clear fraud thresholds, suspicious activity flags, and manual review workflows can help identify this behavior before it becomes costly.

Loyalty fraud is a serious and growing challenge, but it's one that businesses can tackle head-on with the right strategies and tools. When you understand what loyalty fraud is and how it happens, companies can build fraud prevention into their loyalty programs from the ground up, from program design and internal controls to cutting-edge technology features and a secure loyalty provider. The goal is to protect both the company's assets and the customer's trust. After all, a loyalty program is meant to reward your best customers, not expose them (or you) to risk.

In summary, loyalty fraud prevention is well worth the effort. It safeguards millions of dollars in reward value, preserves your brand's reputation, and ensures your loyalty program continues to drive genuine customer delight and engagement.

Businesses that have successfully curbed loyalty fraud do so by staying proactive: they monitor continuously, adapt to emerging fraud tactics, and leverage specialized software capabilities to stay one step ahead of fraudsters.

Follow these best practices outlined above, so that by strengthening security, watching for anomalies, tightening controls, and using a robust loyalty platform, you can keep your loyalty program secure, trusted, and poised for long-term success.

Get a weekly dose of actionable tips on how to build and grow gamified successful loyalty programs!